Beauty and fashion brands are showing varied performance in their quest for creator marketing supremacy, according to Traackr’s “July 2025 Creator Marketing Performance Rankings.” The report, which tracks brand visibility through a proprietary metric called VIT, Traackr’s brand vitality score that measures creator attention, highlights shifts in how companies are capturing creator attention across the U.S., the UK, and French markets, with some brands maintaining dominance while others make surprising jumps in the rankings.

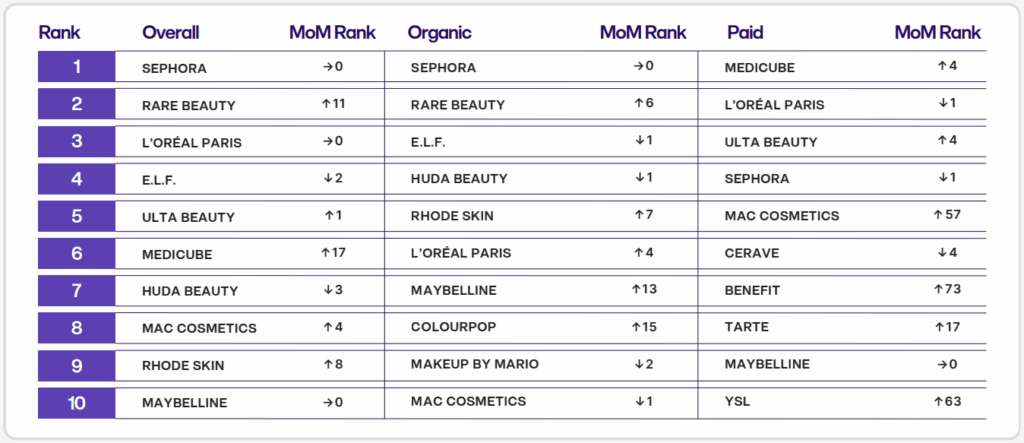

Beauty Market: Sephora Maintains Dominance While New Contenders Emerge

Sephora continues to hold the top position in the U.S. beauty market, maintaining stability with no change in rank month-over-month. The retailer leads in both overall and organic rankings, demonstrating strong creator relationships without heavy reliance on paid campaigns.

Rare Beauty showed notable growth, climbing 11 positions to secure the second spot in overall U.S. beauty rankings. The brand particularly excelled in organic content, rising six positions in that category.

The most notable development in the U.S. beauty sector is Medicube’s quick rise. The Korean skincare brand jumped 17 positions to rank sixth overall, fueled by aggressive paid creator activations.

“Medicube hit a new monthly high of 4.7k creators in July, nearly doubling the benchmark,” the report notes, highlighting how the brand has strategically invested in boosting high-performing content to extend reach.

In the UK, Huda Beauty maintained its position at the top of beauty rankings, while Tatti Lashes and Vieve emerged as important newcomers, with impressive climbs of 80 and 85 positions respectively. This suggests major shifts in creator attention within the British market during the summer season.

The French beauty market saw NYX take the top position, with L’Oréal Professionnel and Garnier rounding out the top three.

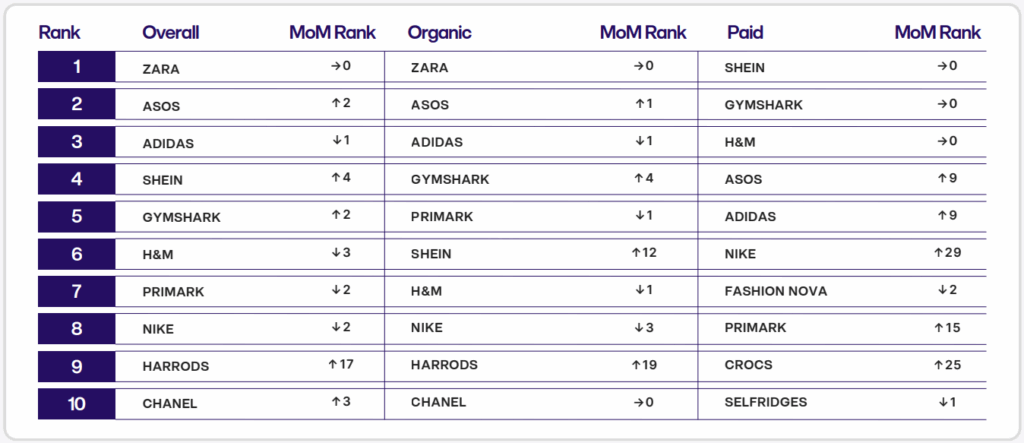

Fashion Market: Established Players Hold Ground While Seasonal Brands Surge

Fashion Nova maintained its leading position in U.S. fashion rankings, showing stability across both overall and organic categories. Gymshark rose one position to claim second place overall, outperforming benchmarks across all key performance metrics.

The most dramatic movement came from Frankies Bikinis, which surged 112 positions to rank third overall in U.S. fashion, likely benefiting from seasonal summer content and creator interest in swimwear during July.

In the UK fashion sector, Zara remained the market leader with no change in rank, while Harrods climbed 17 positions to enter the top ten at ninth place. The French fashion rankings saw Nike claim the top spot with a nine-position increase, while Celine jumped 26 positions to rank third overall.

How Brands Are Measured

The rankings are based on VIT, which combines four key performance indicators: creator volume, posting frequency, average audience size, and content performance.

Creator volume represents the total number of creators mentioning a brand, while frequency measures how often each creator posts about the brand. Average audience size captures the reach per creator, and content performance evaluates engagement and view rates relative to the potential audience.

Case Studies Reveal Contrasting Growth Strategies

The report presents detailed case studies of two brands demonstrating notable momentum: Medicube in the beauty sector and Gymshark in the fashion industry. Their contrasting approaches highlight different paths to success in creator marketing.

Medicube: Paid Activation Drives Quick Growth

Medicube’s strategy centers heavily on paid creator activations, with 73% of its VIT coming from paid content. The brand’s approach to the U.S. market focuses on a strong platform, with 89% of Medicube mentions occurring on TikTok, generating 79% of the brand’s total VIT.

Strategic boosting of content played a crucial role, with 62% of total VIT coming from boosted posts as the brand amplified top-performing paid content. Medicube also employed a tiered creator approach, with VIPs and mega-influencers generating 40% and 30% of VIT, respectively, while nano and micro creators accounted for 78% of posts.

“Medicube’s July centerpiece was Alix Earle, who spotlighted Medicube’s Age-R device in a sponsored TikTok routine,” the report states. “The brand amplified the moment by coordinating a wave of creators across tiers posting around the same theme, then boosting top performers to extend reach.”

The analysis suggests Medicube’s next challenge will be “translating paid momentum into long-term retention and organic growth” by developing deeper creator relationships that endure beyond paid campaigns.

Gymshark: Ambassador Network Fuels Sustained Momentum

In contrast to Medicube’s paid-heavy approach, Gymshark’s success stems primarily from organic content, with 92% of VIT coming from content classified as organic. Gymshark has built a multi-platform presence, with Instagram driving 68% of VIT and YouTube generating 20% of the brand’s attention, nearly twice that of any other fashion brand in July.

“Gymshark’s July momentum was powered by its ambassador ecosystem, where both male and female creators consistently drove attention with workout fits, training clips, and daily gym culture content,” the report observes.

The report specifically mentions key creators driving Gymshark’s success: “On the men’s side, top creators like Chris Bumstead, David Laid, and LATMAN sparked attention with training journeys and progress updates. Meanwhile, creators like Annabel Lucinda, Keiani Mabe, and Sara Saffari drove momentum through frequent fit checks, workout updates, and discount code shoutouts.”

This balanced creator tier approach enables Gymshark to maintain consistent visibility. While VIPs and mega-influencers generate 70% of VIT, micro and mid-tier creators account for 55% of posts, sustaining momentum at scale. The report credits Gymshark’s success to a deep and active ambassador base that extends its reach across all corners of the gym culture, with consistent content that keeps the brand top-of-mind without major launches.

Performance Metrics Reveal Growth Opportunities

When examining specific performance metrics, the contrasting strategies of these brands become even clearer. Medicube demonstrated exceptional creator volume (4,747 vs. benchmark 2,452) and content performance (6.06% vs. benchmark 3.60%), but had a lower average audience size (81,260 vs. benchmark 126,629).

Gymshark, meanwhile, outperformed benchmarks across all metrics, with particularly strong content performance (8.23% vs. benchmark 4.30%) and frequency (2.97 vs. benchmark 1.96). This consistent outperformance across all factors helped Gymshark secure its position as the second-ranked fashion brand in the United States.

The report frames these metrics as actionable growth factors for marketing professionals. To improve creator volume, brands should focus on retaining existing creators while expanding reach. For better frequency, developing deeper relationships with the right creators is key. Improving average audience size requires prioritizing and retaining top-tier talent, while enhancing content performance demands a focus on cultural relevance and optimization for engagement rates.

Image credit: Traackr

Get the full report here

link